Lower churn & improved customer lifetime value

Recurring payment methods enable seamless premium withdrawals that require no action from the client and significantly reduce involuntary churn rates.

Transition insurance clients from invoice to direct debit and start reaping the benefits of digital payment solutions right from the start. Opt for a positive customer experience and boost retention and improve customer lifetime value thanks to our intuitive checkout and onboarding.

Recurring payment methods enable seamless premium withdrawals that require no action from the client and significantly reduce involuntary churn rates.

Save on costs associated with invoices. Forget about invoice printing, shipping, and manual invoice and payment processing. Reduce not only costs and workload but also the environmental impact of your insurance company.

Deliver agreements in a digital form that allows for immediate onboarding. Sign customers up for recurring payment methods in just a few clicks and concurrently improve the initial payment rate.

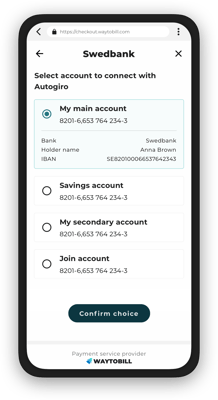

Convert invoice customers to direct debit and forget about missed or late payments, errors and suspensions in insurance coverage for your clients. With Digital Autogiro, Digital AvtaleGiro, and other Nordic direct debit payment methods, you can forget about involuntary churn and significantly reduce administrative workload. Automate payment processes and allow your customer support team to foster relationships instead of chasing missed payments.

On top of that, you can still offer invoice and card payments.

Let your customers focus on things that matter and take their minds off monthly payments. Sign customers up for recurring payments, wherever they are.

With our effective telesales checkout, you can insure customers while on the call or directly after. Send the checkout link directly to your prospect's mobile phone, making the signing process easier and faster.

Waytobill's checkout can be used across all sales channels. Convert customers directly from your website or customer portal and redirect them to secure online checkout.

Print QR codes on your marketing materials for further reach and increase your insurance volume.

.webp?width=350&height=350&name=insurance%20direct%20debit%20payments%20with%20waytobill%20(1).webp)

At Waytobill, we know that ensuring your clients' maximum security is fundamental for you as a trustworthy insurance provider. That's why we have taken trustworthiness to another level thanks to our partnership with Kontakta, BankID and 3D payments.

Oct 17, 2024 by Magnus Bendelin

The Nordic region, a leader in digitalisation, faces challenges in modernising recurring insurance payments. Discover...

Sep 24, 2024 by Magnus Bendelin

The rise of insurtech has transformed the insurance industry,...

Aug 7, 2024 by Kamila Palka

One of the most recent advancements we've implemented is an improved checkout process, particularly within the account...

Take control and improve customer retention with a simple payment solution.

Your effortless checkout journey awaits.